Published in Blog on May 07, 2024 by Matt May

For any grassroots effort attempting to effect true and significant change in politics, half of the battle is merely showing up.

Read more ›

Published in Blog on May 07, 2024 by Matt May

For any grassroots effort attempting to effect true and significant change in politics, half of the battle is merely showing up.

Read more ›

Published in Blog on May 08, 2024 by Jakob Fay

We, like the revelers on May 8, 1945, ought to be out in the streets, gratefully vaunting the heroism of the U.S. armed forces.

Read more ›

Published in Blog on May 07, 2024 by Matt May

A new and inspiring podcast dedicated to grassroots leadership stories and strategies

Read more ›

Published in Blog on May 07, 2024 by Jakob Fay

Twelve departing members of Congress spill the tea about about rampant dysfunction.

Read more ›

Published in Blog on May 06, 2024 by Jakob Fay

The grassroots did not disappoint.

Read more ›

Published in Blog on May 06, 2024 by Article V Patriot

The federal government has grown far beyond its original design: spending too much, regulating too much, and taking more and more power away from the states.

Read more ›

Published in Blog on May 06, 2024 by Matt May

Highlights from the National Day of Prayer event

Read more ›

Published in Blog on May 03, 2024 by Jakob Fay

America is under attack by an avowed Communist you have never heard about before.

Read more ›

Published in Blog on May 02, 2024 by Jakob Fay

Join us for an unmissable evening of inspiration, education, and patriotism.

Read more ›

Published in Blog on May 02, 2024 by Matt May

Great work being done by North Carolina team

Read more ›

Published in Blog on May 02, 2024 by Matt May

Mark Meckler subs for Kirk Cameron

Read more ›

Published in Blog on April 28, 2024 by Susan Quinn

Determined to set limits on the federal government.

Read more ›

Published in Blog on April 14, 2024 by Garrett Ringler

A great day of hope & promise.

Read more ›

Published in Blog on April 08, 2024 by Michael Arnold

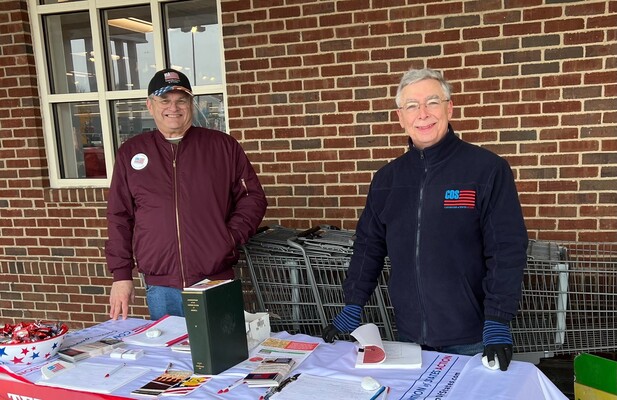

Saturday April 6, 2024 was a cold and blustery day outside the Stop and Shop in Quincy Massachusetts. A cloudy and windy 39 degrees made for a chilling tabling event.

Read more ›

Published in Blog on May 01, 2024 by Article V Patriot

According to our latest endorser, the federal government has grown far beyond its original design: spending too much, regulating too much, and taking more and more power away from the states.

Read more ›

Are you sure you don't want emailed updates on our progress and local events? We respect your privacy, but we don't want you to feel left out!