Frank Herbert (Dune, 1965):

Governments, if they endure, always tend increasingly toward aristocratic forms. No government in history has been known to evade this pattern. And as the aristocracy develops, government tends more and more to act exclusively in the interests of the ruling class - whether that class be hereditary royalty, oligarchs of financial empires, or entrenched bureaucracy.

- Politics as Repeat Phenomenon: Bene Gesserit Training Manual”

An Analogy about Debt, Interest, and Inflation

If a friend asked you for money, you may "loan" some money out at no interest to your friend. But if others came to you in increasing numbers for money, you'd become reluctant to hand it out.

In order to entice you to keep handing out more and more your money, people would begin to offer you interest, the more people and the more money requested -- the higher the offered interest rate must be in order for you to be willing to lend so much of your hard-earned dollars out to others.

If you ran out of money to lend to others, but at a time when the interest rate was high enough to support your lifestyle if you could go on borrowing to them, you might try to borrow money -- just so that you could keep on lending money out to others.

If your friend worked at the Federal Reserve, you could ask him to print out cash for you, which you would then borrow, just so that you could lend it out to others. If your friend complied with your request, you could afford to accept lower interest rates than if your friend refused to print money for you.

Why the US, for a short time, was able to increase debt without extra interest or inflation

While this analogy is extremely unlikely, it is a good picture of how debt must be dealt with. Rising debt always ends up in either rising interest rates, or rising inflation.

There is a short time in which debt can rise without rising interest rates or rising inflation, if you agree to sell off the ownership of your personal assets. That's what the US did when running huge trade deficits prior to 2008, we sold-out our own domestic ownership to foreigners.

It allowed for debt to rise, but without either causing interest rate hikes or inflation.

So there are really 3 avenues that debt leads down, but after the first one is exhausted, you only have options 2 and 3:

1) allow others to take greater and greater control of your private property

2) rising interest rates

3) rising inflation rates

But you can't keep selling off your personal ownership to others. At some point -- i.e., when foreign ownership of domestic corporations passes 50% -- you no longer "own" your own company like before.

At that point, foreign interests can then direct domestic firms to do their bidding, such as to adopt such stringent climate standards that profits can no longer be made -- and living standards can no longer improve.

Welcome to the USA in 2022.

Who benefits from the demise of the USA?

Because of an oligarchy of financial interests -- as predicted by Frank Herbert in 1965 in the quote at top -- there is a powerful special interest group which benefits off of US debt and demise. When people can hold you in debt, they sort of "own" you.

Ever wonder who it is that owns government debt?

Financial oligarchs do.

Ever wonder who REALLY benefits from stringent government controls?

Financial oligarchs do.

How often have we heard it that the "save-the-little-guy" stimulus plans ended up bailing out the rich? Regular people were not bailed out in the Great Recession -- but Big Banks were bailed out, under the excuse that they were "too big to be allowed to fail."

Debt, spending, and controls, all helping the oligarchs but none of it helping the masses. It's a ruse that worked for decades in Communist nations which have been run into the ground on different versions of that same, old, stale, catch-phrase:

"From each according to his ability, to each according to his need."

A solution to it all

A Convention of States to propose course-correcting amendments to the U.S. Constitution can put a stop to this self-destructive oligarchy of financial interests. It's really, really important that we have one.

Here is what to expect if a Convention of States is prevented by that same oligarchy, beginning with the debt trend:

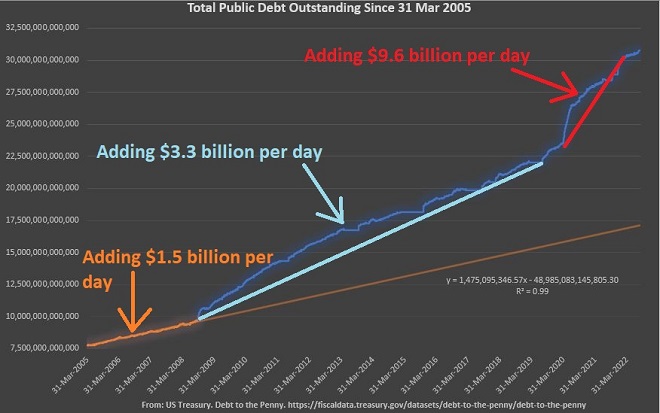

When debt grows by $9.6 billion dollars per day, it means that you are spending, daily, $9.6 billion dollars more than you are taking in each day -- a rate of overspending that, when annualized, is an excess of $3.5 trillion per year.

Such debt growth has consequences though. As we learned before, you can only sell-off so much of your own personal ownership in things before one of two things must eventually happen: rising interest or rising inflation.

Because private investors are savvy enough to understand that that is the case, then as the debt grows, the relative ability to stimulate economic activity shrinks -- because any new debt then has a stronger upward pressure on interest rates (or an inflation risk; if interest rates are magically kept low).

No good investor will keep investing while knowing that deeply negative economic effects are coming, due to debt having been out of control.

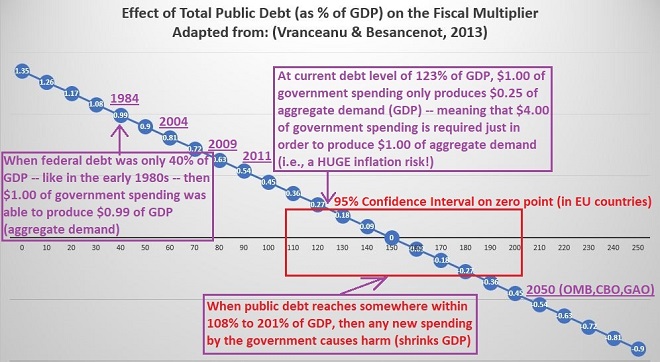

If debt grows high enough, economic stimulus is hampered (the "fiscal multiplier" drops too low), so that stimulus begins to increase inflation, which can then only be tamed by increasing interest rates until a deep and prolonged recession occurs -- all caused by the original debt in the first place:

At bottom right you can see the projections by major outfits like the Office of Management & Budget (OMB), the Congressional Budget Office (CBO), and the Government Accountability Office (GAO).

Under a business-as-usual scenario with rising interest rates, federal debt exceeds 200% of GDP by about 2050 -- making any new government spending completely counter-productive.

It's not that government spending will have no effect if and when we pass a debt threshold of about 200% of GDP. It's that government spending will have a harmful effect, shrinking our GDP.

It is what happened to the U.S.S.R. -- when the people were impoverished by the government programs -- and it is the reason why they failed. They thought that slogans could replace sound financial behavior, but here's the news:

There is nothing on planet Earth that can replace sound financial behavior.

Our future

Economic interventionism is not a sustainable process: it always leads to either higher interest or inflation, until regular people can no longer afford a decent standard of living.

It's a 2050 where only 1 in every 8 or 9 people can afford to own a car, and you will then have to ask around for a ride if you want to go somewhere (if the government even lets you travel).

Pictures of communist Cuba in the 1990s, where the newest car that you see on the road was a 1959 Chevy, should serve as a warning for what is coming to America if current trends continue.

It's a 2050 where people are careful not to have more than one child (if even that), because it had become too costly to feed them. It'd be a "One Child Only" policy by de facto, even if not legislated.

And owning your own home? You'll pass by 30 people on the street before you come across someone who can afford to own their own home.

It's a 2050 where the 'horizon of hope' has been shortened for people born into the country which, for good reason, had been the envy of the world.

If current trends continue, it is the future which we have to look forward to.

Our hope

A Convention of States can put a stop to this predictable demise of America. It is the only peaceful and legal solution which can prevent it.

Dozens and dozens of Tea Party members were elected in 2010, but the Swamp prevented them from implementing government reform. A Convention of States is our "fail-safe" though, thanks to the foresight of the Framers. We don't have to fail like every past republic has failed, in a seedbed of corruption springing out of the narrow interests of oligarchs.

Work to convince your local representative to support the Convention of States resolution to claw back power from the D.C. Swamp and return it to the 50 states where it belongs. Our future, and that of our children, is what hangs in the balance.

Reference

Quote from Dune: https://www.goodreads.com/quotes/95127-governments-if-they-endure-always-tend-increasingly-toward-aristocratic-forms

Records showing Total Public Debt growing exponentially for 4 decades: The Debt to the Penny and Who Holds It. https://treasurydirect.gov/govt/reports/pd/debttothepenny.htm

Records showing Total Public Debt has passed 108% of GDP: U.S. Office of Management and Budget and Federal Reserve Bank of St. Louis, Federal Debt: Total Public Debt as Percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEGDQ188S

Research showing how debt, if it passes 108% of GDP, eventually destroys fiscal stimulus plans: Veronique de Rugy & Jack Salmon. Declining Fiscal Multipliers and Inflationary Risks in the Shadow of Public Debt. https://www.mercatus.org/publications/spending-deficits-debt/declining-fiscal-multipliers-and-inflationary-risks-shadow

Research showing how the US is set to reach that level of debt which causes economies to collapse: Committe for a Responsible Federal Budget. https://www.crfb.org/papers/analysis-cbos-july-2022-long-term-budget-outlook

The U.S. Government admitting [paraphrased] "Yes, our debt REALLY IS that bad.": Government Accountability Office. https://www.gao.gov/products/gao-22-105376

Our Mission: To build a strong, engaged army of self-governing citizen activists.