The late Senator Tom Coburn would often say that the federal government gets away with irresponsible fiscal policies because no one forces them to use standard accounting practices.

In other words, they fudge the numbers.

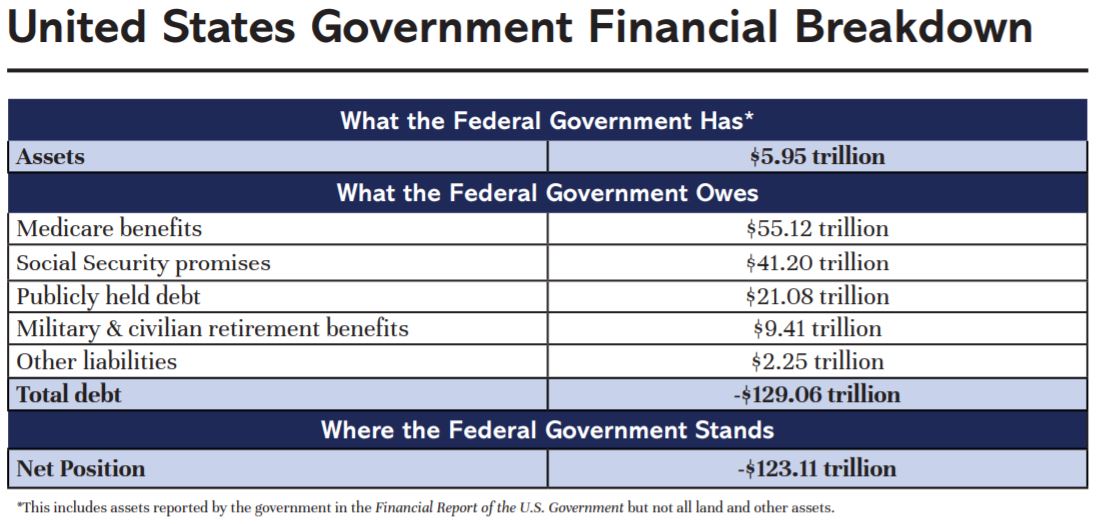

The national debt is a great example. Officially, our country's national debt stands at an astounding $28 trillion. That number is high enough, but it doesn't take into account unfunded liabilities.

When we include these unfunded liabilities, the true national debt (i.e., the money the federal government has promised but hasn't paid) jumps up to a whopping $123 trillion.

That's according to a new report from the nonprofit Truth in Accounting.

"Our measure of the government’s financial condition includes reported federal assets and liabilities, as well as promised, but not funded, Social Security and Medicare benefits," the report states. "Elected and non-elected officials have made repeated financial decisions that have left the federal government with a debt burden of $123.11 trillion, including unfunded Social Security and Medicare promises. That equates to a $796,000 burden for every federal taxpayer. Because the federal government would need such a vast amount of money from taxpayers to cover this debt, it received an 'F' grade for its financial condition."

If an American business managed their finances the way the federal government manages our money, it would be out of business within the year. Not counting unfunded liabilities is a recipe for disaster, and Washington doesn't even maintain a cash reserve in case of disaster.

Our country's finances are hanging on by a thread, and only the strength of the American dollar is keeping us from financial collapse. If the dollar deteriorates before we've gotten our fiscal house in order, we can expect the worst depression we've ever seen.

Congress has shown no willingness to institute the kinds of fiscal reforms necessary to avert disaster. They're content spending our money for their reelection, and they seem totally unconcerned about the future consequences of their actions.

Fortunately, there is a solution--and it's found in the Constitution.

An Article V Convention of States is called and controlled by the states and has the power to propose constitutional amendments that force the federal government to be fiscally responsible. These amendments can require Congress to balance the budget every year while also capping spending and limiting taxation. That way, federal officials can't simply raise taxes to balance the budget. They'll have to do the hard work of cutting spending, even if it means that they risk losing reelection.

Over five million Americans have voiced their support for this constitutional solution. Fifteen states are on board, and we only need an additional 19 to trigger a Convention of States.

Help us get there! Sign the petition below to let your state legislators know you want them to join the call for a Convention of States.